Exit Planning

Do you have a business transition plan?

Did You Know?

50% of all and 67% of baby boomer business owners hope to exit their companies within the next 5 years.

80% of All business owners have 90% of their net worth tied up in their business

83% of business owners have no plan.

There are many tools available to help individuals get into business, but, unfortunately, there are few that help them get out. That is where we can help.

Without a strategic business transition plan your goals of building a valuable asset for the future or selling your business can be elusive. Value acceleration and exit planning strategies will increase your opportunities for success in either scenario and guide you away from common entrepreneurial traps by focusing your attention on value drivers.

There are numerous exit and transition strategies available. OPS offers value acceleration and exit planning services tailored to your specific business and personal goals to help you understand and decide which internal and external options are best for your situation. We will create a comprehensive plan that integrates your life goals with all aspects of your financial life, including pre- and post-liquidity planning, risk management through insurance, contingency planning, legacy planning, as well as the impact of both income taxes and potential estate taxes.

You probably have a large portion of your net worth tied to the value of your business, and if you’re like most business owners, you probably don’t know what your business is actually worth. Many business owners face the following challenges:

75% of business owner that sold, regret it later, because they did not plan properly.

Business owners are leaving too much $ on the table because they are focused on income generation; not focusing on enterprise value.

70%-80% of business put on the market don’t sell.

50% of businesses do not survive the death of their owner. Be wary of the “5 D’s”

Death

Disability

Divorce

Distress

Disagreement

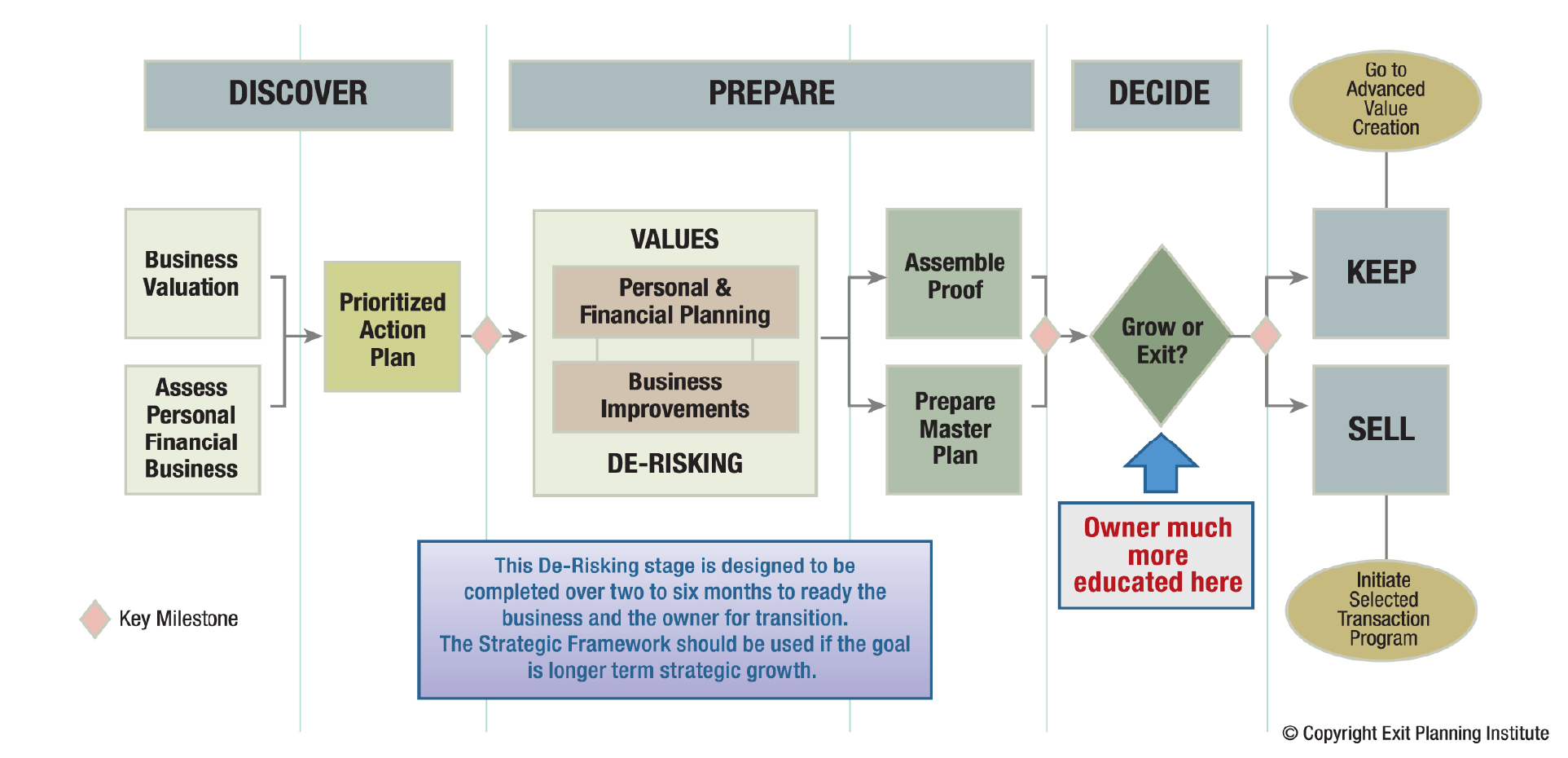

That is why the following Exit Planning Institute’s Methodology for Value Acceleration and Exit Planning is so useful.

Exit Planning Institute, 2020, EPI Value Acceleration Process. www.exit-planning-institute.org. Copyright 2022 Exit Planning Institute.

The first step of the Value Acceleration Methodology™ is called the triggering event, which is both a business valuation and a personal financial plan. By working on both the business valuation and your personal financial plan, we can determine your Wealth Gap, Profit Gap, and Value Gap.

Why is understanding all of this important?

Your Wealth Gap is the amount of money you need to support your personal financial goals minus your Net Worth minus the business value. This is important to know because this helps us determine the minimum amount of money the business needs to sell for to sustain your financial goals. Depending on how big the Wealth Gap is (coupled with the Value Gap) and the timeframe, it can help us determine if we need to develop a savings and investment strategy or if we need to focus on increasing the value of the business to reach that goal.

The Profit Gap and Value Gap are ways for us to determine the business valuation’s potential growth and what your business could potentially be worth if you, as the owner, want to increase the valuation.

The Profit Gap is your business’s EBITDA compared to both your industry’s average EBITDA and Best-in-Class EBITDA.

The Value Gap is your business’s valuation multiple based on your EBITDA compared to the multiple you would receive if you had either the Average or Best-in-Class EBITDA.

There are also other benefits of Business Readiness without wanting to sell such as:

Increases annual income and enterprise value

Provides sound business practices and strategies

Prepares for unsolicited offers

Provides a contingency plan